What is Yield Farming? A Beginners Guide to Earning Interest

Decentralised finance, or DeFi, seeks to decentralise classic financial services. By utilising intelligent contracts, which are programmable features up-to-date on the blockchain, DeFi protocols are equipped to run an computerized, trustless and permissionless service.

Should go through

DeFi protocols are experimental is effective in progress. Cash deposited into DeFi protocols in standard can be at possibility of intelligent agreement vulnerabilities, destructive developers and hacks. DeFi Protocols are generally governed by token holders via a DAO (decentralised autonomous organisation).

The range of platforms and programs in this sector of the cryptocurrency market has greater drastically in excess of the last 3 many years. One particular of the a lot more lucrative improvements for cryptocurrency buyers is getting the option to lend cryptocurrency holdings for a return on expense. This course of action in DeFi is frequently referred to as generate farming.

Disclaimer: This details should really not be interpreted as an endorsement of cryptocurrency or any distinct

provider, service or providing. It is not a suggestion to trade.

What is generate farming?

Produce farming is the course of action of lending cryptocurrency assets to DeFi protocols so that the assets, or “liquidity”, can be utilised by other people. In return for lending electronic assets, people are rewarded with a lot more cryptocurrency tokens. It is a way for cryptocurrency buyers to earn passive money from electronic assets that would usually be sitting down idle.

The course of action is very similar to staking as it involves depositing and locking cryptocurrency holdings for a specific period of time. Nevertheless, even though staking takes advantage of cryptocurrency tokens to energy a blockchain or protocol, generate farming takes advantage of cryptocurrencies as liquidity for other buyers or traders.

All those that take section in generate farming and provide liquidity to DeFi platforms are acknowledged as liquidity suppliers (LPs). The liquidity is frequently made use of for decentralised exchanges, investing or financial loans. As the sector advances, there will without doubt be even a lot more use instances in the potential.

At the time of composing, the overall price locked (TVL) in DeFi protocols by liquidity suppliers is $sixty five billion.

How generate farming is effective

Produce farming is created possible by the software of automatic market place makers and liquidity pools, which are made use of to energy decentralised exchanges or lending platforms.

Liquidity suppliers, people trying to find to earn interest from idle cryptocurrency holdings, can deposit their money into a liquidity pool. Liquidity pools can be believed of as a “pot” of cryptocurrencies that other people can use for exchanges or financial loans. To use the pot of cryptocurrencies, the user has to fork out a payment. These service fees are then distributed proportionally to liquidity suppliers based on their share of the liquidity pool. The rewards are commonly in the type of cryptocurrency tokens.

Automatic market place makers are algorithms (a sequence of intelligent contracts) that calculate the trade selling prices and interest fees on a platform centered on the out there liquidity held in liquidity pools.

Automatic market place makers (AMMs) spelled out.

Rules bordering the distribution of service fees and the length of time cryptocurrency assets ought to be locked in can vary among protocols. The use of AMMs and liquidity pools has facilitated the expansion of generate farming in the sector.

Produce is the once-a-year return that a liquidity provider can acquire for lending cryptocurrency assets. This is frequently written as a share, both as once-a-year share amount (APR) or once-a-year share generate (APY). As the AMM calculates interest fees applying supply and desire, as opposed to classic economic investments, yields can vary every day.

Produce farming refers to the course of action where liquidity suppliers move liquidity among large-generate pools to take gain of these dynamic adjustments in generate. Getting the the best possible generate could involve relocating to a various liquidity pool on the exact same platform or altering platforms completely.

Lots of DeFi protocols mint liquidity provider tokens when a user deposits cryptocurrencies into a liquidity pool. For instance, if a user deposits ETH into the borrowing and lending protocol Compound, they would acquire cETH tokens in return. The token signifies the user’s stake in the liquidity pool and assures custody of the deposit remains with the user.

Produce farming methods

Produce farming can be straightforward with a liquidity provider lending cryptocurrency assets to just one platform. On the other hand, buyers can utilise complex methods to maximize returns. This involves relocating cryptocurrency assets among liquidity pools to capture the most effective interest fees.

With a selection of platforms providing generate farming prospects, there is no “most effective way” to generate farm. Hazard management should really constantly be the emphasis as opposed to large-generate returns. A user requirements to comprehend the protocol and keep on being in handle of their money through.

Automatic generate farming

Thanks to greater recognition, there are now platforms that automate generate farming, which can be appealing for many passive buyers. Produce farming can be time consuming and puzzling for people at first coming into the place, so automatic solutions are a good resolution.

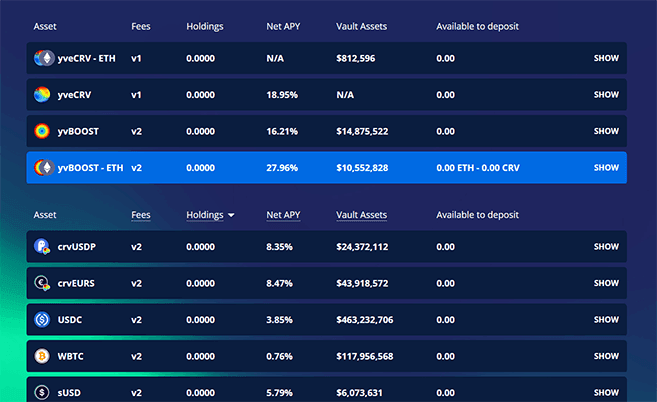

- Yearn Finance. This is a decentralised DeFi aggregator that compares the generate farming prospects from a assortment of DeFi protocols. A user can deposit cryptocurrencies into a “vault” that will then be distributed to the most effective accomplishing liquidity pools. The vault rebalances periodically to be certain the most effective generate farming option is getting exploited.

How to get started off applying Yearn Finance.

- Zapper.Fi. Whilst not automatic, Zapper.Fi gives people with the option to “zap” in and out of DeFi protocols with a handful of clicks. This greatly simplifies the course of action. It gets rid of the need to have to develop into adequately acquainted with just about every protocol.

How to get started off applying Zapper.

Popular generate farming platforms

The expansion of the DeFi sector has resulted in the expansion of generate farming prospects. In this article is a checklist of some of the most well-liked platforms at this time made use of for generate farming:

- Compound. Compound is a borrowing and lending platform where rewards for liquidity are compounded in excess of time.

- AAVE. AAVE is a decentralised borrowing and lending platform. Desire fees are altered by an algorithm centered on supply and desire.

- MakerDAO. This is a credit rating platform where people can deposit cryptocurrency in return for the US dollar-pegged stablecoin DAI. People then earn interest, which is added to their DAI holdings.

- Curve Finance. Curve Finance is a decentralised trade concentrated on the investing of stablecoins. By focusing on stablecoins, Curve Finance is equipped to present lessen service fees and lessen slippage.

- Uniswap. Uniswap is a decentralised trade that lets people to deposit money into liquidity pools. The liquidity pools are then made use of to facilitate trades.

- Synthetix. Synthetix is a investing platform for synthetic assets backed by the indigenous SNX token. People can deposit indigenous SNX tokens or ETH in return for rewards.

- Yearn Finance. Yearn Finance is a decentralised aggregator for acquiring the the best possible generate across numerous DeFi platforms.

Pitfalls of applying generate farming

Whilst drastically rising in recognition in excess of the last year, the DeFi sector is nonetheless a younger market which suggests that threats need to have to be evaluated diligently.

- Smart contracts. Smart contracts are the spine of DeFi protocols and permit for many of the excellent generate farming prospects on present. Nevertheless, intelligent contracts are programmed by human beings, so glitches can arise. There are devices in area to mitigate this possibility, but if a intelligent agreement does malfunction, it could signify that a user’s liquidity deposit is dropped in the DeFi ecosystem.

- Composability. Smart contracts maximize the composability of DeFi protocols. Composability refers to the interaction of various protocols in the DeFi ecosystem (imagine of various mobile apps all functioning collectively for a seamless experience). This is just one of DeFi’s best strengths, but it can also be viewed as a secondary possibility as it can amplify any issues in a intelligent agreement system.

- Hacks. The decentralised programs that entrance the DeFi protocols are related through the Internet. Like something related to the Internet, there is constantly a possibility of a protection breach from hackers. Hackers also look for cracks in intelligent agreement code that they can use to their gain.

- Rug pulls. With any new market, there are constantly people seeking to exploit new people. Rug pulls are just one this kind of exploitation. Rug pulls are a possibility generally related with decentralised exchanges (DEX). Due to the open up-source character of the blockchain, everyone can produce a new cryptocurrency token. On a DEX, scammers can then produce a new liquidity pool and pair the worthless token with a useful just one, this kind of as ETH. Once sufficient liquidity enters the fraudulent liquidity pool, the house owners pull the pool and leave with the useful ETH, leaving tiny to no trace.

- Impermanent reduction. When depositing liquidity into liquidity pools, this is commonly concluded in equal proportion. For the ETH-USDC liquidity pool, you would need to have to deposit the exact same total of just about every as established by the current trade cost. Nevertheless, if just one of people assets appreciably improves in cost, the liquidity pool would not automatically change. This gives an option for arbitrage traders. They can use the liquidity pool to obtain assets at a lower price and sell at authentic-entire world selling prices. This course of action ultimately brings the liquidity pool again to a harmony. Nevertheless, the course of action will also signify a liquidity provider might stop up with a marginally various ratio of assets in comparison with when they deposited. When withdrawing people assets from the liquidity pool, impermanent reduction takes place if the price of the new ratio of assets is fewer than if they had just remained on an trade or electronic wallet.

Verdict

Produce farming is without doubt just one of the most exciting factors of the DeFi sector. It arms handle to the specific user and delivers the option to place cryptocurrency assets to operate.

The market is nonetheless in its infancy, which comes with related threats, but it is advancing at an unbelievable amount. With just about every progression comes greater protection, enhanced decentralised governance and a lot more prospects.

Produce farming can be straightforward or complex, but it gives cryptocurrency buyers with a way to earn a tiny passive money from usually idle investments.

Disclaimer: Cryptocurrencies are speculative, complex and involve considerable threats – they are highly

volatile and sensitive to secondary activity. Performance is unpredictable and past efficiency is no guarantee of

potential efficiency. Consider your personal situations, and acquire your personal suggestions, right before relying on this details.

You should really also confirm the character of any merchandise or service (which include its lawful position and suitable regulatory

needs) and seek advice from the suitable Regulators’ sites right before making any selection. Finder, or the writer, might

have holdings in the cryptocurrencies reviewed.