Ethereum price could reach AU $13,000 after successful PoS transition, expert suggests

ETHs 24-hour gains currently stand just under the 5% mark

- Despite the success of the recent London Hardfork, ETH has not been able to exit its existing bearish conditions.

- A new EIP — 3675 — that seeks to help initiate Ethereum’s upcoming chain merger from PoW to PoS was issued on GitHub yesterday.

- Most prominent ETH devs, including Vitalik Buterin, believe that the platform’s transition to ETH 2.0 will most likely not take place this year.

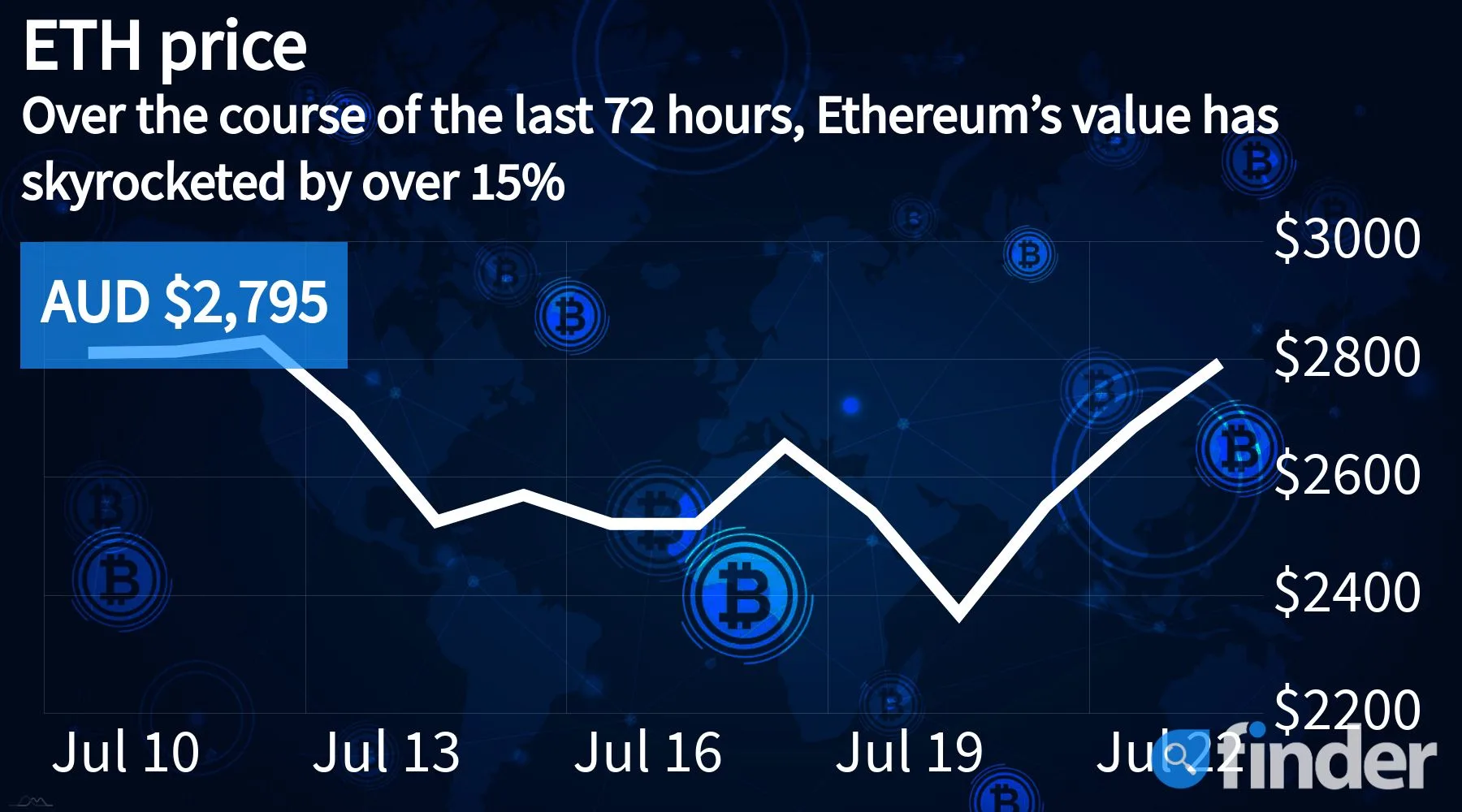

After scaling to a relative low of AU $2,750 a little over 72-hours ago, Ethereum, the world’s second largest cryptocurrency by total market capitalization, has continued to forge an impressive recovery, gaining nearly 10% over the past week. At press time, the premier altcoin is trading for AU $2,830.

Providing his take on Ethereum’s future, Max Krupyshev, CEO of crypto payment gateway CoinsPaid, told Finder that the despite the success of the highly anticipated London Hardfork, the upgrade has not been able to reverse the current bear trend that seems to have engulfed Ethereum, adding:

“The London Upgrade will slightly equalize the network’s commissions, which will in turn increase its overall popularity as well as suspend the flow of projects moving to other protocols. Some of the commissions will be burned, which should also positively affect the asset’s pricing in the long term. ETH could possibly reach US $8,000 – US$10,000 in 2022 after introducing POS and the deployment of sharding.”

Lastly, it bears mentioning that as part of its ongoing ascent, Ethereum is now illustrating a chart featuring “three bearish wicks” — also referred to as the Falling Wedge pattern — which some experts believe may help protect the digital asset from falling any lower.

How to buy Ethereum

Ethereum Improvement Proposal (EIP) 3675 Issued on Github

Earlier today, a formal Ethereum Improvement Proposal (EIP) was created on Github as a means of smoothening the platform’s transition to a Proof-of-Stake (PoS) framework. The proposal was officially submitted when Mikhail Kalinin created a pull-request for EIP-3675 , thereby setting into motion the aforementioned chain merge event that is scheduled to take place in the near future.

On a more technical note, it bears mentioning that the proposal seeks to help alter Ethereum’s native infrastructure irrevocably, empowering stakers to validate transactions. Not only that, it also states that since the inception of the ETH2 beacon chain during Q4 2020, no safety or operational issues have been identified with the platform. The EIP does on to read:

“The long period of running without failures demonstrates the sustainability of the beacon chain system and witnesses its readiness to start driving and become a security provider for the Ethereum Mainnet.”

Looking Ahead

Despite a lot of hype surrounding Eth2, nobody is really sure as to when the transition will actually happen. In fact, many leading individuals within the Ethereum community — including its co-founder and defacto poster child Vitalik Buterin — believe that the merger will most likely happen next year.

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, dive deeper by learning about Ethereum and see what blockchain can do with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.