RBA survey: 58% experts say now not a good time to buy property, predict further price falls

-

-

-

- Gurus and economists forecast ordinary residence rates will tumble in all funds cities by up to ten.5%

- Gurus forecast that unemployment could go as high as eighteen%

- Good sentiment on housing affordability proceeds to be high

-

-

5 Could 2020, Sydney, Australia – Approximately six in ten specialists say now is not a good time to acquire house, in accordance to Finder, Australia’s most frequented comparison web page.

This non-vote of assurance arrives as the Reserve Financial institution of Australia (RBA) today announced a hold on the dollars level for the 2nd consecutive thirty day period, an consequence which was properly predicted by forty of forty two users from the Finder RBA Dollars Rate Survey™.

Gurus and economists have been requested how substantially they anticipate rates to dip by 2021, following the latest predictions of a housing downturn thanks to COVID-19.

Of all the funds cities, Hobart is anticipated to see the premier ordinary rate drop of ten.5% by 2021, followed intently by Sydney at ten.2%.

Darwin and Melbourne have been future with drops of 9.5% and 9.2% forecast, with Brisbane, Perth and Adelaide all anticipated to see drops of around eight%.

Canberra is anticipated to experience the sting the least with drops of only six.4% projected.

Graham Cooke, insights manager at Finder, reported with growing unemployment and increasing economic uncertainty residence rates will slide over the relaxation of the calendar year.

“Each househunter and seller need has weakened in the past thirty day period as Australians hunker down to help halt the unfold of coronavirus.

“It’s not just specialists, we have also viewed purchaser sentiment about regardless of whether it is a ‘good time to buy’ drop from a peak of sixty% in July 2019 to just forty two% in April,” Cooke reported.

Predicted residence value drops across funds cities:

| Metropolis | Fall predicted by %* | Present ordinary residence value** | Fall in $ | Projected 2021 residence value |

|---|---|---|---|---|

| Hobart | -ten.50% | $540,000 | ($56,seven-hundred) | $483,three hundred |

| Sydney | -ten.20% | $935,000 | ($ninety five,370) | $839,630 |

| Darwin | -9.50% | $460,000 | ($forty three,seven-hundred) | $416,three hundred |

| Melbourne | -9.20% | $791,000 | ($72,772) | $718,228 |

| Brisbane | -eight.forty% | $563,000 | ($forty seven,292) | $515,708 |

| Perth | -eight.30% | $515,000 | ($forty two,745) | $472,255 |

| Adelaide | -eight.ten% | $505,000 | ($forty,905) | $464,095 |

| Canberra | -six.forty% | $seven-hundred,000 | ($44,800) | $655,two hundred |

Resource: CoreLogic, Finder

*Average of predictions from 17–25 economists, relying on the town. Inflation has not been taken into account.

** As of 31 Jan 2020, rate improvements from February to Could 2020 have not been taken into account.

In welcome news for the housing current market, New South Wales and the Northern Territory will let open up-residence house inspections and public auctions to restart this coming weekend (9 Could) with other states anticipated to observe suit in the coming months.

Transaction volumes have collapsed in the latest months as social distancing measures introduced an end to common advertising tactics.

Cooke reported debtors could save on their property finance loan by switching to a decrease desire level home bank loan.

“Even though falling residence rates is excellent news for prospective prospective buyers, it poses no relief for existing homeowners who will not see their excellent bank loan amounts drop.

“With costs at rock bottom, now is a much more crucial time than ever to discount for far better value from your financial institution or change loan providers.

“At a time when households are presently stretched, folks will need to know they are receiving the cheapest desire level – that signifies it desires to have a 2 in front,” Cooke reported.

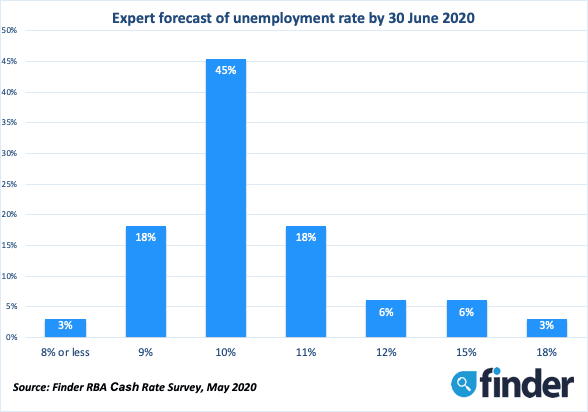

Unemployment to go towards ten%

Gurus agreed with the latest predictions that the unemployment level could hit ten% with eighty% of specialists indicating a last minimal in just one proportion level of that.

5 specialists (fifteen%, 5/32) pointed to a 12% or greater unemployment level.

John Rolfe, head of Elders Household Financial loans expects unemployment to go as high as eighteen%.

Noel Whittaker, executive in residence and adjunct professor at QUT Business Faculty reported the comprehensive influence of COVID-19 is however to be recognized.

“This recession will be far even worse than the government imagines…they can’t shut down so several enterprises and not anticipate a extreme hangover.

“As for serious estate, it really is never a lousy time to acquire a discount,” Whittaker reported.

Financial Sentiment Tracker

Results from Finder’s Financial Sentiment Tracker, which gauges five essential indicators – housing affordability, work, wage advancement, price tag of living and residence personal debt – has viewed modest progress considering the fact that past month’s survey.

Cooke reported good sentiment about housing affordability has taken an fascinating journey over the past 12 months.

“Just less than 50 % of specialists felt good about this metric in mid-2019 as rates have been falling.

“When the current market started out surging once again in December and January this began to plunge, reaching six% by February 2020.

“1 good of COVID-19 is that economists are once once again emotion quite good about housing affordability.

“Buyers with a deposit completely ready to go could be the most powerful players in the current market suitable now,” Cooke reported.

![]()

This is what our specialists had to say:

Commentary

Nicholas Frappell, ABC Bullion (Lower): “The influence of the sluggish down with expectations of a ten% contraction in H1, put together with expectations in the dollars futures current market tilted towards a reduction. With effective dollars costs at around .fifteen%, yet another reduction could just formalise the existing effective level circumstance.”

Alison Booth, ANU (Lower): “[The RBA will slice] due to the fact of the condition of the financial system.”

Nicholas Gruen, Lateral Economics (Maintain): “They really should slice to zero or beneath, but they’ve reported they would not. I hope they modify their intellect. Anyway, the crucial points are now taking place in fiscal policy as monetary policy can’t do substantially in this situation.”

Shane Oliver, AMP Money (Maintain): “The dollars level is as minimal as it really is going to go and the future go in costs will be up but it really is at least three many years away, possibly much more. The RBA has reported on various events that it regards .twenty five% as the effective decrease sure for the dollars level. Dependent on the experience of other nations there is no value in having costs adverse. So any additional easing in monetary policy will have to come from quantitative easing. In the meantime the coronavirus connected shutdown will bring about a huge hit to advancement that will just take many years to completely recover from. This in switch will necessarily mean that it will be several many years in advance of we see comprehensive work and inflation in the target vary of 2–3% which in switch will necessarily mean level hikes are several many years away.”

John Hewson, ANU (Maintain): “Recession/flat financial system will past more time than anticipated.”

Malcolm Wood, Baillieu (Maintain): “RBA on hold at effective zero for several many years.”

David Robertson, Bendigo and Adelaide Financial institution (Maintain): “No much more desire level cuts required (not effective beneath this ‘lower bound’ of one/4 %) – and no will increase will happen till ‘full employment’ obtained: 2022/23?”

Peter Boehm, Boehm (Maintain): “I feel desire costs will continue to be wherever they are for the foreseeable long run and till these time as there is much more certainty on wherever the financial system is heading immediately after COVID-19 is introduced less than manage. Suitable now, I do not anticipate the outlook to be overly good for the remainder of this calendar year and possibly into future calendar year as properly, possibly in this article in Australia or abroad. It is challenging to forecast if/when desire costs could possibly go when it really is really hard to forecast with realistic certainty what the financial system could possibly look like over the future 6 months, let alone future calendar year.”

Ben Udy, Money Economics (Maintain): “I do not feel the RBA will modify the dollars level in the future two many years as the governor has reported.”

Saul Eslake, Corinna Financial Advisory (Maintain): “The RBA has explicitly indicated that it would not raise the dollars level till it has manufactured progress towards comprehensive work and inflation in just the 2–3% target band. I am sceptical of forecasts of a ‘V-shaped’ recovery from the existing downturn, and feel that the RBA will keep the dollars level at its existing degree for at least 2 many years.”

Craig Emerson, Craig Emerson Economics (Maintain): “The RBA has publicly said the dollars level at .twenty five% is the decrease sure.”

Trent Wiltshire, Area (Maintain): “The RBA would not be elevating the dollars level for the future several many years.”

John Rolfe, Elders Household Financial loans (Maintain): “We are going into an enforced recession. I can’t foresee when this will end as we are displaying minimal or no probability to reverse even though even now in lockdown. The recovery level will drive.”

Mark Brimble, Griffith Uni (Maintain): “COVID impacts feel likely to endure for a period of time and the financial system will will need guidance in the medium term to stabilize and then rebuild.”

Tony Makin, Griffith University (Maintain): “The timing of any long run dollars level modify will count on how and when the lockdown limitations are lifted, and on how rapidly the financial system is anticipated to spring again.”

Peter Haller, Heritage Financial institution (Maintain): “The RBA has fully commited to a dollars level at the effective decrease sure for at least the future two many years.”

Alex Joiner, IFM Buyers (Maintain): “It will be a very lengthy time in advance of the RBA returns to traditional policy. It will wind again its unconventional policy very first and then will need to see product progress, in conditions of recovery, of the labour current market the timeline for this is unknowable at this phase but I was suspect it will be further than 2022.”

Andrew Wilson, Independent Economist (Maintain): “There are unlikely to be any moves in the close to long run. The RBA are likely to just take a “wait and see” tactic and keep the remaining leverage they have. No conclusions are likely till the economic repercussions of COVID-19 turn into clearer.”

Leanne Pilkington, Laing+Simmons (Maintain): “The Reserve Financial institution Governor not too long ago challenged the Government to target on advancement and efficiency techniques to help the financial system, finally, emerge from the COVID-19 crisis. Additional effective taxation options which include the removal of stamp duty is an clear spot to start out. Fascination costs are presently rock bottom and on this score the RBA has performed its component.”

Nicholas Gruen, Lateral Economics (Maintain): “They really should slice to zero or beneath, but they’ve reported they would not. I hope they modify their intellect. Anyway, the crucial points are now taking place in fiscal policy as monetary policy can’t do substantially in this situation.”

Mathew Tiller, LJ Hooker (Maintain): “The RBA is anticipated to maintain its existing policy to guidance the financial system by means of COVID-19.”

Geoffrey Harold Kingston, Macquarie University (Maintain): “Pursuing 1–2 many years of falling inflation, there is a good probability inflation will finally select up, as a belated consequence of huge stimulus.”

Jeffrey Sheen, Macquarie University (Maintain): “Indications from RBA that dollars level is likely to keep on being at its all-time minimal for a several many years.”

Stephen Koukoulas, Sector Economics (Maintain): “The recovery will be in comprehensive swing and inflation force could be rising.”

John Caelli, ME Financial institution (Maintain): “The RBA has obviously indicated that the dollars level will not go up for substantially of the future three many years.”

Michael Yardney, Metropole Assets Strategists (Maintain): “It is unlikely the dollars level will go for a range of many years.”

Mark Crosby, Monash University (Maintain): “There is much too substantially uncertainty re the length of the influence of COVID19. More level cuts would not encourage the financial system, and the concern now is of the sort and character of QE in 2020 and 2021.”

Julia Newbould, Revenue (Maintain): “I feel there could have been some symptoms of recovery.”

Susan Mitchell, House loan Option (Maintain): “I anticipate the Reserve Financial institution to hold the dollars level at its monetary policy assembly in Could. In his speech on the 21st of April, Governor Lowe reported that the dollars level was to keep on being at .twenty five% till we make sustainable progress towards the target of comprehensive work and inflation. We are even now ready for economic information to reveal the extent of the influence of the COVID-19 pandemic but the most current indicators recommend that desire costs will have to continue to be minimal for more time. As anticipated, purchaser sentiment plummeted to an all-time minimal in April, with Westpac reporting the single greatest regular drop in the forty seven calendar year background of the survey. Social distancing measures have knocked the wind out of the sails of the house current market but time will explain to if this will translate to declining dwelling values.”

David Lowe, Newcastle Lasting Developing Culture (Maintain): “The RBA have been steady in advertising and marketing the decrease for more time level natural environment, and by concentrating on the three calendar year bond level at .twenty five%, it is indicating a period of around three many years of costs at the existing degree.”

Jonathan Chancellor, Assets Observer (Maintain): “The RBA has advised they would not go to zero, so the future go ought to be up, but to a completely unidentified timeline.”

Abundant Harvey, Propertybuyer (Maintain): “No modify. Charges are presently at the cheapest degree the RBA has indicated they are prepared to go. Following go from in this article is QE and new fiscal policies to kick start out the financial system immediately after hibernation.”

Matthew Peter, QIC (Maintain): “The RBA will not be in a position to raise costs for at least four many years. The existing influence on advancement dictates costs at the decrease sure till the end of 2021. Just after that, high amounts of government and personal sector personal debt will necessarily mean the RBA can’t lift desire costs.”

Noel Whittaker, QUT (Maintain): “We are living in an unsure globe, even the funds has been pushed again to Oct. There are much too several unknowns to make any sort of significant predictions.”

Jason Azzopardi, Resimac (Maintain): “Inflation will not enhance for a lengthy time maintaining costs minimal.”

Sveta Angelopoulos, RMIT University (Maintain): “Tough to estimate at this level and will count on the level of limitations currently being eased and enterprises currently being ready to return to buying and selling will also count on regardless of whether the easing of limitations end result in yet another outbreak and if limitations are imposed once again.”

Christine Williams, Smarter Assets Investing Pty Ltd (Maintain): “I believe that once we come out of ISO and Retail, Tourism (in just Australia) and Hospitality are at comprehensive working capacity the RBA will enhance the level to recoup our holdings.”

Besa Deda, St.George Economics (Maintain): “Governor Lowe has manufactured it very clear in his speeches that the dollars level will keep on being at its decrease sure for some time. We will will need to see the removal of the three-calendar year bond target and the associated unwinding of quantitative easing. A level hike is thus not likely to happen in just the future three many years.”

Brian Parker, Sunsuper (Maintain): “Following level enhance is further than the scope of the dates furnished.”

Mala Raghavan, University of Tasmania (Maintain): “I am not positive if any accommodative (traditional and unconventional) monetary policy measures will help to revive the financial system, considering that the COVID-19 crisis has a larger effect on the source-facet of the financial system relative to the need-facet. I am not positive if flushing the financial system with liquidity aids to encourage the financial system, except and till the pandemic is contained.”

Andrew Reeve-Parker, NW Suggestions (Maintain): “The level would not modify for a lengthy time.”

Other members: Bill Evans, Westpac (Maintain). Angela Jackson, Fairness Economics (Maintain).

###

For additional data

Disclaimer

The data in this launch is exact as of the day released, but costs, costs and other products functions could have transformed. Make sure you see current products data on finder.com.au’s evaluate web pages for the existing accurate values.

About us

Every single thirty day period 2.2 million distinctive website visitors switch to Finder to save revenue and time, and to make crucial life options. We compare pretty much anything from credit playing cards, telephone strategies, health insurance, travel bargains and substantially much more.

Our no cost services is a hundred% independently-owned by two Australians: Fred Schebesta and Frank Restuccia. Due to the fact launching in 2006, Finder has served Aussies come across what they will need from one,800+ brand names across a hundred+ types.

We go on to expand and start around the world, and now operate in the United States and the United Kingdom. For additional data visit www.finder.com.au.